ABB is a budgeting model used at the University of Washington to govern the distribution of a portion of incremental operating revenues to units. ABB is designed to provide greater transparency in the budgeting process. The University distributes revenues to schools and colleges using ABB principles, which means these funds aren’t distributed at the departmental level, but rather, each dean determines how to allocate funds within their school or college.

Under ABB, central resources, such as tuition revenue and indirect cost recovery (ICR) from research, are allocated directly to the unit responsible for the activity. First, however, a tax is taken to fund central operations and administration, strategic investments in student and faculty experience, and critical compliance efforts — shared expenses that would otherwise have no direct source of funds.

ABB includes distribution rules for three types of revenue: 1.) net tuition (operating fee) revenue, 2.) indirect cost recovery (ICR) from grants and contracts, and 3.) miscellaneous student fee revenue (e.g., revenue from application fees). The miscellaneous fee category represents only 1% of the sum of these three revenue sources, so we’ll focus here on net tuition revenue and ICR.

Under ABB, 70% of net tuition fee revenue is distributed to schools and colleges, and 30% is retained by the Provost for basic university functions and strategic investments. ICR has been shared at the dean level for many years prior to ABB (historically, this sharing was known as RSA and, later, RCR). Under ABB, 35% of ICR is returned to schools and colleges.

Both tuition revenue and ICR are distributed to deans of schools and colleges, rather than at the departmental level.

The ABB tax is applied to tuition and research activities, as well as to miscellaneous fees. These funds are kept centrally to help offset the many costs that are incurred centrally rather than locally: for example, utilities, facilities and maintenance, grounds and landscaping, policing, human resources, central advising, and both research and academic administration. These funds are also used to provide support for academic units that cannot, on the basis of tuition alone, be self-supporting. Any increases in ABB revenue held centrally constitute Provost Reinvestment Funds, which are used by the Provost to make strategic investments in both academic and central support units.

No. ABB isn’t the reason why the University has limited funding. The 2007-2009 Great Recession required cutbacks in the face of increasing costs, and revenues since then haven’t increased sufficiently to overcome those previous cuts. It’s likely that the University will continue to have limited funding for some time, which makes the planning enabled by ABB even more important.

Embedded in ABB is the principle that, in a modern research university, there will be cross-subsidies. ABB identifies the existence of subsidies, thereby providing an opportunity for them to be discussed.

ABB fosters, but does not demand, self-reliance. In its most basic form, it’s a method of budgeting in which revenues generated from instructional and research activities are allocated directly to the unit responsible for the activity. ABB empowers greater local planning and accountability, and creates incentives for units to more efficiently manage resources and expenditures. Further, direct control of resources generated from activities creates incentives to set priorities and develop new activities consistent with the University’s overall mission and strategic goals.

The Provost consults with deans, students and faculty regarding priorities for central funding, including libraries. (Library expenses are included in the central operating expenses that are funded by the ABB tax and tuition revenue.) Groups consulted include the board of deans and chancellors, Provost’s Advisory Committee for Students, Faculty Senate, Senate Committee on Planning and Budgeting, and elected faculty councils.

Deans, chairs and faculty must be diligent in finding ways to participate in and encourage collaboration. Revenue sharing works for everyone if the advantages of collaboration for recruitment and retention of faculty and students are understood and valued. In 2014, the board of deans and chancellors endorsed a Statement of Collaboration, and the concepts noted in the statement need to be supported through actions. The document also provides best practices to foster discussions between faculty, chairs and deans, and between dean-level units.

When the University implemented ABB, there was no change to a unit’s total General Operating Funds (GOF) plus Designated Operating Funds (DOF) budget. The total GOF/DOF budget remained the same, but it was broken into three new conceptual budget categories, based on ABB methodologies: 1.) the calculated tuition value, 2.) the indirect cost recovery (ICR), which was determined to be 35% of the prior year’s total grant activity, and 3.) the remaining amount, known as the supplement. Thus, each unit’s budget was the same immediately after implementation as it was before ABB was implemented.

Going forward, additional allocations of funds are made each year that can and do change the value of the three ABB budget categories: new tuition dollars, changes in research activity and/or ICR, and a variety of changes to the supplement (for example, state funds for benefit changes and compensation, or Provost Reinvestment Funds for backfilling tuition cuts or any other initiative). There are a variety of reasons why the value of a unit’s budget may change. Allocations of incremental tuition revenue and ICR are guided by ABB principles, and the Provost, in consultation with the board of deans and chancellors, Senate Committee on Planning and Budgeting, and Provost’s Advisory Committee for Students, decides on the level of the supplement.

The University’s resources have always been limited, and innovative ideas have always outstripped the resources available to support them. In this way, ABB doesn’t change how innovation is supported. If a particular innovation requires funding, then it must effectively compete with all other funded efforts.

Investing in innovation is a strategic decision. An example would be that a new, innovative course might have fewer students initially than another, but the newer course is expected to provide much better preparation for later courses, and enrollment might be predicted to grow. Keeping the old course rather than starting the new one might be financially beneficial in the short run, but it’s not an ideal strategic decision. Ultimately, ABB is a budget model intended to support the strategic plans in dean-level units, not to be the driving force behind the strategic plans. Optimistically, by better understanding and predicting the flow of funds, chairs, deans and the Provost can more confidently invest in innovation.

ABB provides transparency and predictability around the budgeting process. Subsidies are deliberate rather than accidental, and they can be strategically managed.

Special cases are handled through discussions between the Provost and deans. Because deans disperse ABB revenue, they‘re empowered to respond to units that are challenged and bring concerns to the Provost when a response isn’t attainable. Ultimately, ABB provides the transparency and predictability needed to manage a large, complex organization, but the UW’s core values require us to prioritize sustainability for the key components of our mission.

Deans are accountable to the Provost, and all budget issues receive input from the faculty (the Senate Committee on Planning and Budgeting, Faculty Senate or elected faculty councils) and students (the Provost’s Advisory Committee for Students).

Under ABB, incremental tuition revenue is distributed to schools and colleges, rather than to departments or individual faculty. If you’re responsible for increasing the share of undergraduate student credit hours, then your school or college will receive additional tuition revenue, and budgeting within the school or college will occur in whatever manner the dean chooses.

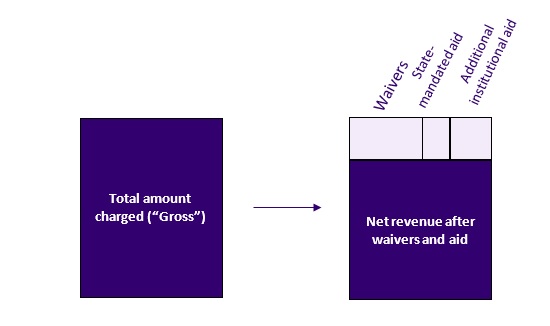

Gross operating fee revenue is the sum of the operating fee that is charged to all students before any exemptions or waivers are taken into account. We waive tuition and award financial aid in order to ensure equal access and attract the best students — there’s no expectation that every student will pay the full tuition “sticker price.” In recent years, net operating fee revenue has typically represented 80% of the total amount charged (gross revenue).

Slightly more than half of the difference between gross and net operating fee revenue is accounted for by tuition waivers, most of which are provided to graduate teaching and research assistants. (Please note that tuition waivers represent forgone revenue, rather than an expenditure.) The rest of the difference is associated with the portion of tuition revenue that’s set aside for financial aid. The UW is required by the state to use 4% of total collections for need-based aid. In addition, UW Regents have chosen to devote an additional portion of tuition revenue to help ensure equal access. The bulk of this additional aid is awarded to undergraduates and, therefore, is subtracted from undergraduate revenue. As a result, the main source of the gap between gross and net tuition revenue for units that serve mostly graduate students is the amount of revenue forgone by waiving tuition for graduate assistants. The bulk of the gap for units serving mostly undergraduate students is aid that’s employed to ensure access for undergraduates.

Given the different sources of the gap between gross and net tuition for different groups of students, the net-to-gross ratio varies dramatically by group. For example, the net-to-gross ratio for the Nonresident Graduate Tier I category is 26%, whereas the ratio for undergraduate nonresidents is 91%.

Indirect costs, also known as Facilities & Administrative costs or F&A costs, are those costs incurred for common or joint objectives that can’t be identified readily and specifically with a particular sponsored project. F&A costs are defined by the Federal Office of Management and Budget in the Federal Uniform Guidance. More information is available at this F&A brief.

The indirect cost rate is the rate applied to eligible expenses on a grant or contract budget to track the amount the sponsor will reimburse the University to help cover F&A costs. This rate varies, depending on the sponsor and the type of research carried out (see the current indirect cost rate table).

Indirect cost recovery is the dollar amount the University receives as reimbursement from a sponsor to help cover F&A costs. It should be noted that this reimbursement doesn’t cover all the F&A costs that support research activity at the University, in part because the administrative portion of the costs is capped at 26%.

The University receives the indirect cost reimbursement from sponsors and allocates the funds based on ABB principles and guidelines. Dean-level units that generate ICR retain 35% to support their portion of administrative costs. The other 65% is used by the Provost to fund campus facilities and research administration costs, and to allocate to units based on initiatives and other criteria. The ICR allocated is based on the grant activity of the prior year.

Thirty-five percent of the ICR is returned at the dean level. Depending on the unit’s local policies and guidelines, a portion of the ICR may be reallocated to departments and/or principal investigators through local campus budgeting procedures, but each unit has its own policy. The principal investigator shouldn’t assume they will receive a portion of these funds. In all cases, the intent is to support the research effort within the dean- or vice president-level unit.

ABB provides a somewhat different ICR return to units, but it’s difficult to determine the precise difference, given the complicated pre-ABB methodology for calculating indirect cost return. Spot-checks have shown that, in general, dean-level units have more ICR return post-ABB than pre-ABB. Additionally, the indirect cost return rate increased for on-campus grants, which are the majority of funding for all units, so we would predict a net increase in indirect cost return after ABB implementation. The number and types of grants and the mix of on- and off-campus grants within any given unit vary from year to year, which also affects ICR. These factors make it difficult to determine whether, and in what direction, ABB specifically impacted a unit, or if fluctuations in the indirect cost rates and location mixes are the reason for shifts in ICR allocations. It’s most likely a combination of factors, not one specific factor.

A grant’s indirect cost rate has an impact on the amount of indirect cost recovery (ICR) dollars. The 35% return rate is applied to the ICR amount, which in turn impacts the allocation to the school/college. Lower indirect cost rates yield fewer ICR dollars, and higher indirect cost rates return more ICR dollars. So if a school/college/department/PI has a majority of grants and contracts with low indirect cost rates, then the ICR return is lower for that school/college/department/principal investigator.

Off-campus grants have facilities charges (rent or lease costs) as a direct cost, decreasing the indirect cost rate that’s charged. Therefore, the ICR per direct cost dollar is less for an off-campus grant than for an on-campus grant. However, off-campus research activities may have increased costs to the administering unit, so the net costs to the unit should be considered when assessing the indirect cost return for on-campus versus off-campus grants

A Faculty Council on Research survey of faculty indicated no significant impact on collaboration.

The UW has guidelines about the sharing of indirect cost return. Because it’s difficult to develop a one-size-fits-all policy, flexibility is allowed, but the concept of revenue sharing is the same for all. In general, ICR should be allocated according to where the work is carried out. It should be noted that the reimbursement rate for F&A costs is lower than actual costs, so no unit is fully reimbursed for the indirect costs of supporting research at UW.

A portion of ICR was returned to units (as RCR) for many years before ABB implementation, so the fluctuations in this revenue stream aren’t new. ICR returns depend on the total grant activity and the ICR rate for each grant; using those figures enables units to track ICR expenditures and project revenue returns throughout the year.

No. Once a grant is awarded, the actual indirect cost rate doesn’t change; if the grant moves to a new location, the old rate moves with it. A rate doesn’t change until the grant is renewed or a new grant is established.

Prior to ABB, ICR budgets could be summarized by selecting DOF budgets using the correlating budget type/class category. This is no longer possible. Now that ABB has been implemented, the value of each unit’s ICR is continuously tracked via ABB tables and allocations, which are published on the web. These activities are taxed at a rate outlined by ABB. The tax is part of the funds the administration uses to address the President’s and Provost’s priorities for the University. Deployment of these funds is the result of a lengthy and highly consultative budget development cycle.