January 30, 2003

Money 101: Students can bank on it

It’s a financial jungle out there, especially for college students.

With tuition rising, the economy in shambles and credit card applications littering everything from shopping bags to daily newspapers Ruth Johnston saw the writing on the wall. UW students, she realized, need support.

So Johnston, the assistant controller for Student Fiscal Services, came up with the idea for Money 101 — a seminar designed to help students develop a firm grasp of money management.

“We started offering credit card payments as a tuition payment option recently,” she said. “There’s a lot of demand for credit card payment, but at the same time we don’t want students to incur any more debt then they have to.”

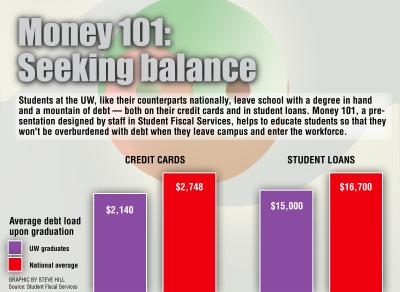

She pointed out that UW students already leave campus with an average of more than $2,100 in credit card debt on top of $15,000 in student loan debt.

The SFS Outreach Unit has been conducting the Money 101 sessions since before the fall quarter began. The list of their clients includes UW sororities, the Graduate Opportunities and Minority Achievement Program, Dentistry, Chemistry, the Office of Minority Affairs, and even some local high schools.

“The most common reaction we get is that this is very much needed,” said Diane Cooley, manager of the SFS Outreach Unit and one of the employees who regularly makes the pitch for responsible money management. “One person asked if the seminar could be a requirement for all students. It’s not, but we’ll give it to whoever will listen.”

The presentation focuses on six aspects of responsible money management: budget, earnings, investments, loans, credit cards and credit reports.

“Our goal is to give them skills, or when that’s not possible, to point them in a direction where they can learn more on their own,” Cooley said. “A firm grasp of money management is increasingly important for survival. That’s basically what we’re trying to give them — those survival skills.”

In one scenario discussed during the seminar, the Money 101 crew actually helps the student figure out a workable budget based on typical student expenses. But the scope of the sessions can reach far beyond what would be beneficial to the average college student.

For example, they also cover the topic of investing in the stock market. That’s because Johnston wanted the sessions to promote the idea of long term fiscal responsibility.

“We wanted them to have skills that would be useful while they are here and when they leave,” she said.

If it weren’t so well intentioned, one might call the group’s investing game a cruel joke. Students are given $10,000 to invest in a select group of stocks. The investment date, for the purposes of the game, is Jan. 1, 2000.

After watching their investments generally skyrocket for the year they are asked to reinvest the play money on Jan. 1, 2001. By the end of that year, of course, the earnings the students enjoyed in 2000 are completely gone. The game was borrowed from the UW Treasury Office in order to make a point about market volatility.

“We’re not going to give them investment advice,” said Kyra Worrell, another SFS employee and Money 101 presenter. “But it does make the points that the stock market goes up and it goes down, that diversification is a good thing, and that investments should be made over the long haul.”

The work the group does in area high schools is intended to prepare future students for the kind of money management challenges they will face as undergraduates. And in the case of their seminar at Forest Ridge — an all-girls high school — they presented the material with a feminist twist.

“It was given in conjunction with Women’s Empowerment Day as a way to encourage women to manage their own finances,” Cooley said.

But in fact, the Money 101 presentation is good for almost any audience. Cooley herself said she’s learned a thing or two about money management while planning the sessions.

“There’s good information in there for just about everyone.”

To schedule a Money 101 presentation or to sign up for one that’s already planned, contact the Student Fiscal Services Outreach Unit at sfscust@u.washington.edu.